Job Market Paper

The Value of Local Public Goods: Evidence from Massachusetts’ Property Tax Limits

Abstract

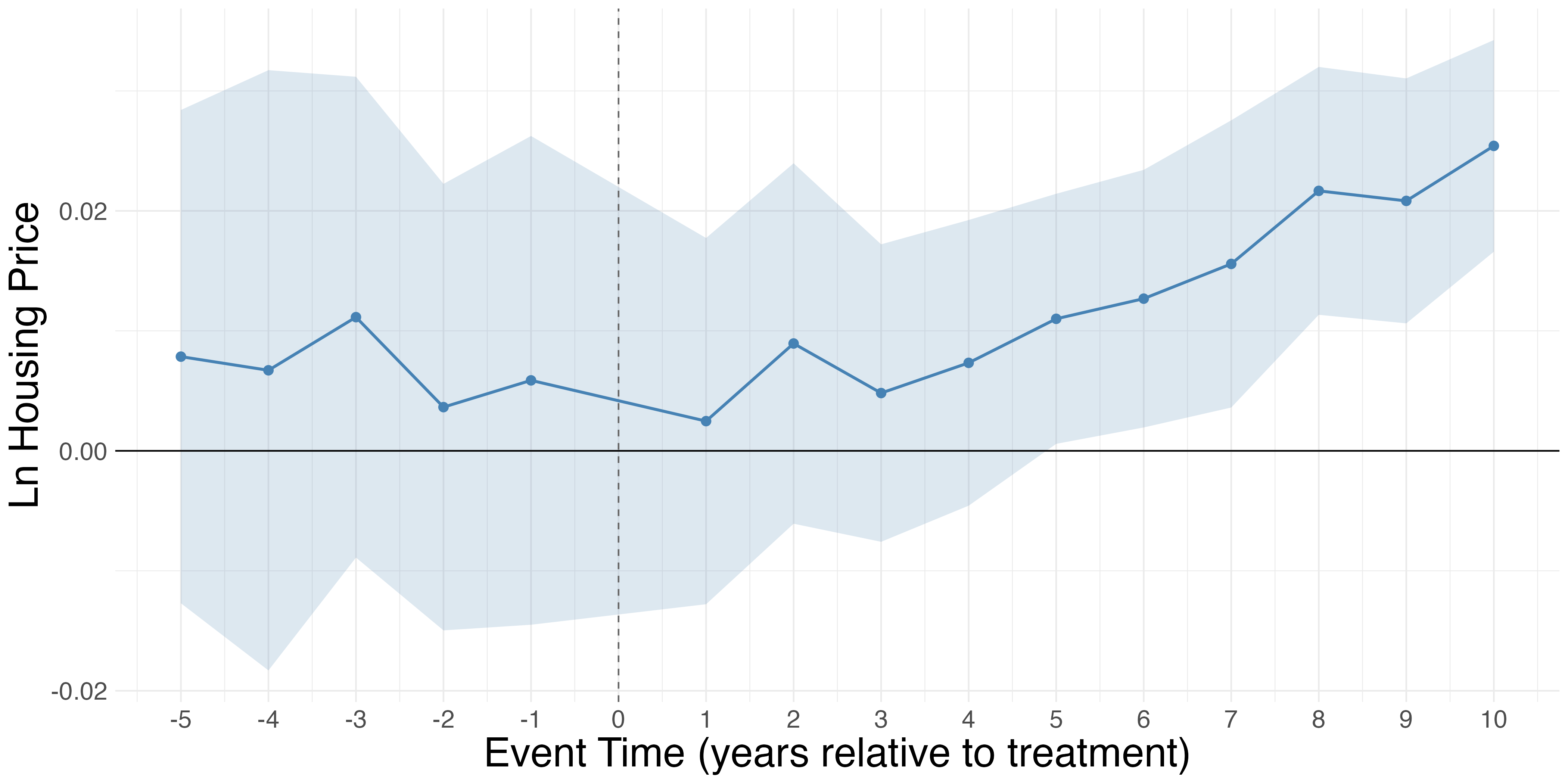

This paper quantifies households’ willingness-to-pay for local public goods using Massachusetts’ Proposition 2½, which caps annual property tax increases but permits voter-approved overrides to finance specific projects. Using a novel dataset of all proposed tax overrides from 2001–2023, we implement a dynamic regression discontinuity design that leverages close-margin elections. We find that passing an override causes a sustained 2.8% increase in housing prices over ten years. This estimate rises to 4% in a boundary discontinuity design comparing adjacent properties across municipal borders, controlling for unobserved neighborhood characteristics. We show this capitalization is driven by an influx of higher-income households attracted by improved public services. Consistent with this mechanism, overrides lead to a 3.5% increase in per-pupil spending and a cumulative 25% increase in teacher expenditures, while the enrollment share of low-income students simultaneously declines. A back of the envelope computation reveals that homeowners are willing to pay approximately $2 in present value for each $1 of override-funded spending.

Working Papers

Do Public Goods Actually Reduce Inequality? (with M. Castanheira & C. Tricaud)

Abstract

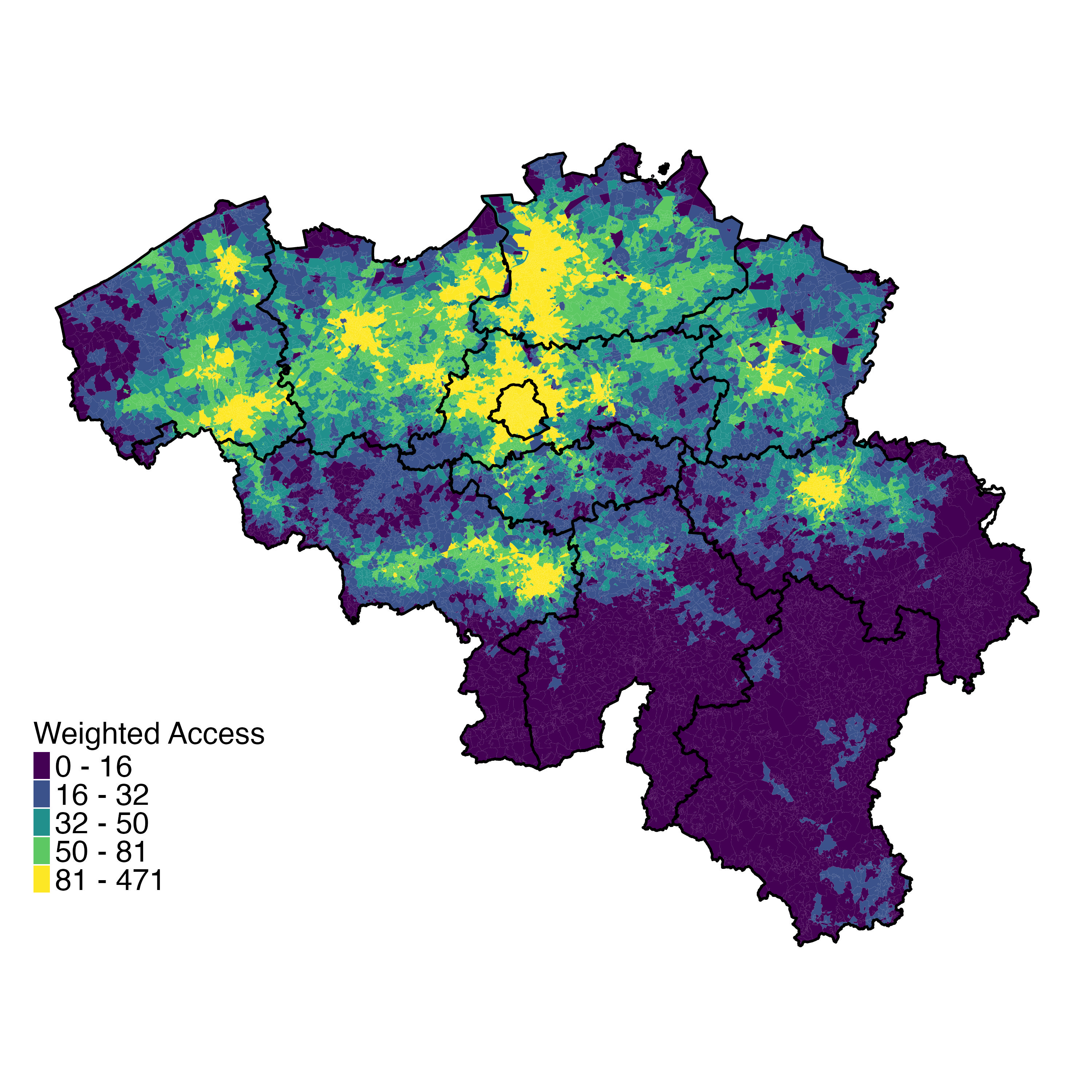

Public goods are meant to be universal, but they are inherently place-based. This paper systematically measures spatial access to public goods and quantifies the implications of distance to public facilities for income inequality. First, we map all schools and hospitals across Belgium. We compute the distance to facilities for each of the 20,000 neighborhoods and document large spatial inequalities in access to public facilities. Second, we find that this unequal distribution favors high-income neighborhoods: allocating public goods spending proportionally to our access index increases income inequality compared to measures based solely on disposable income. Third, we show that the positive relationship between income and access can be rationalized by a simple model of public goods allocation with an inequality-neutral social planner. Finally, we provide evidence that access is strongly correlated with educational and health outcomes, emphasizing the need to consider the place-based nature of public goods when measuring inequality.

Housing inequality in the US (with G. Domènech Arumí & L. Ma)

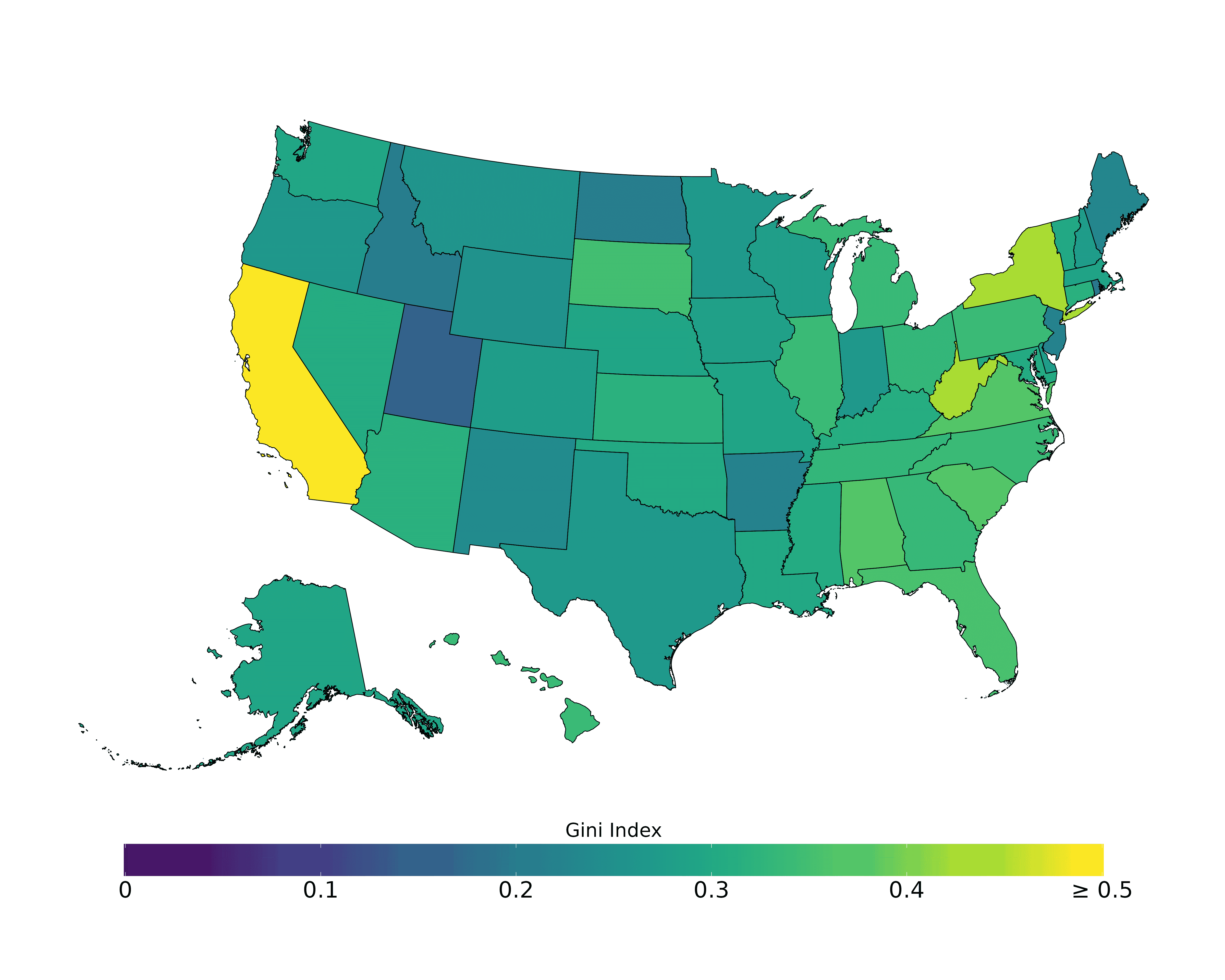

Download the data: WHID DataAbstract

We use county assessor and property deed records to construct, analyze, and disseminate contemporaneous and long-run estimates of housing inequality for the United States and its subnational levels. A dwelling in the top decile is eight times as valuable and four times as large as a dwelling in the bottom decile, and 12% of all housing assets are held by 1% of households. Housing value inequality has increased since the 1980s, while housing space inequality has remained relatively stable. Heterogeneity is substantial, with considerable variation between and within states, commuting zones, and census tracts. Income, land-use regulations, and housing supply and demand are associated with current and changing levels of housing inequality. This research highlights the importance of granularity when studying inequality and evaluating policies. We make all estimates publicly available to facilitate such work.

Housing inequality in Spain (with G. Domènech Arumí)

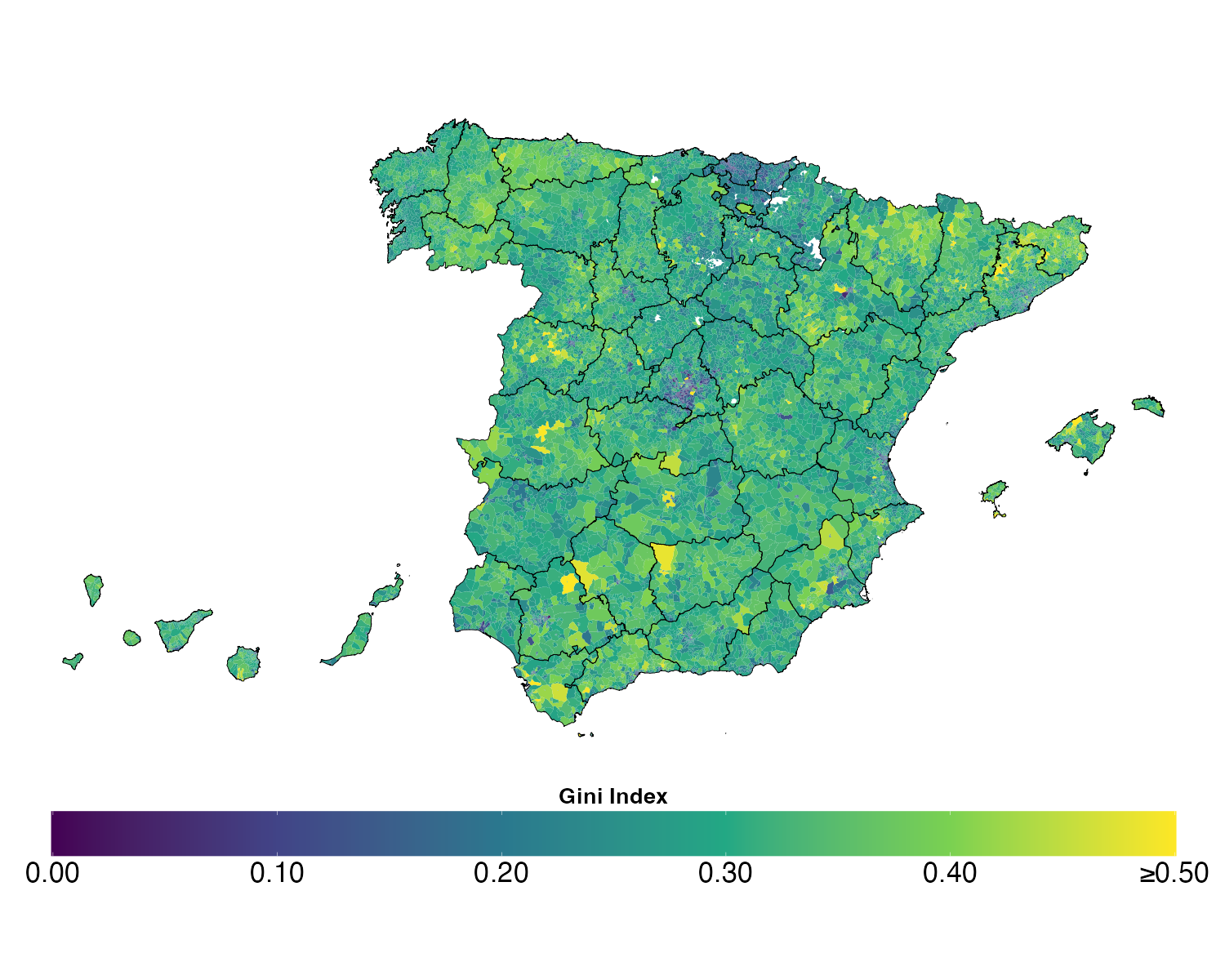

Download the data: WHID DataAbstract

We use data on the universe of real estate in Spain and recent real estate transactions in Catalonia to construct novel contemporaneous and long-run housing inequality estimates for Spain at all existing levels of aggregation. Housing inequality in Spain is large, with the top 1% most spacious and valuable dwellings accruing over 6% of total residential space (square meters) and value. These estimates put Spain in between the US and Belgium in terms of inequality. Long-run series show that space inequality was much higher at the beginning of the 20th Century and declined significantly in the 1960s, coinciding with a boom in housing supply. Housing value inequality increased between 2009 and 2019, likely due to cyclical changes in aggregate demand and stagnating new housing supply. We document significant heterogeneity across all levels of aggregation and a correlation between housing value and income inequality, suggesting a connection between the two. This research introduces a new publicly available database to study housing-related topics and highlights the importance of granularity when evaluating policies related to inequality and housing.

Work in Progress

Public Goods, Housing Markets, and Residential Sorting: Evidence from Italy’s Municipal Consolidation

Abstract

How much do households value local public goods, and how do changes in public service provision affect residential sorting? This paper addresses these questions by exploiting Italy’s 2010 inter-municipal cooperation reform (Law 78/2010), which mandated service consolidation among municipalities below 5,000 inhabitants. The reform exogenously reduced physical access to local amenities—schools, transit, administrative services—while weakening municipalities’ ability to tailor policies to local preferences. Using administrative data on housing prices, real estate transactions, and the geospatial distribution of public services, I employ a difference-in-discontinuities estimator to identify the reduction in public goods access and its causal effect on housing market outcomes. I first document that consolidation significantly reduced amenity accessibility using a novel geospatial accessibility index, then estimate how this reduction capitalized into housing prices.

Publications

- Des Biens Publics pas si Publics que Ça (with M. Castanheira) in Decoster, A., Decancq, K., De Rock, B., and P. Gobbi (eds.) (2024), Inégalités en Belgique. Un paradoxe, Editions Racine, Bruxelles